How Fenergo Can Help

Faster Onboarding

Risk Monitoring

Digital Experience

Explore Fenergo's Solutions

FinCrime Operating System

Fenergo’s next-gen FinCrime Operating System, a single platform that unifies onboarding, KYC, screening, ID verification and transaction monitoring, powered by Agentic AI.

Learn more

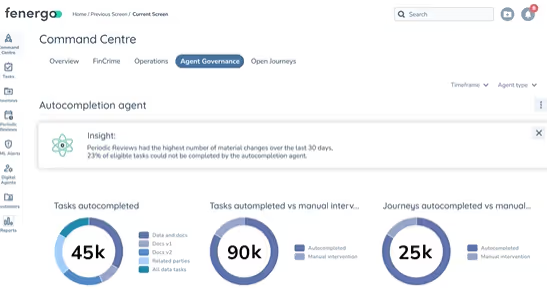

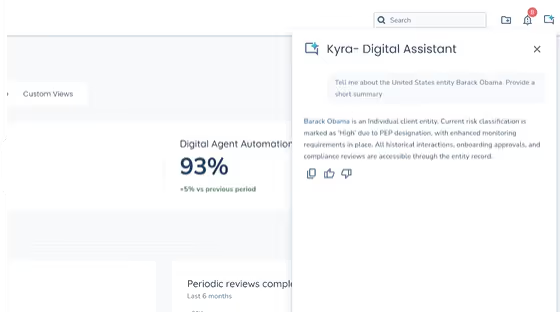

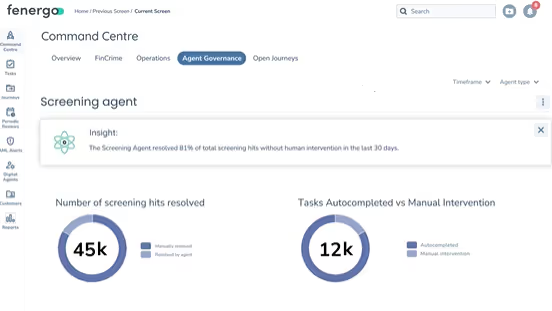

AI Agents

Integrated within FinCrime OS, our intelligent, purpose-built agents are redefining client lifecycle management—delivering greater speed, accuracy, and compliance.

Learn more

Know Your Customer / Business

Digitalize the end to end KYC/B process for clients and merchants throughout the entire lifecycle. Simplify and automate due diligence with pre-packaged KYC/B rules and workflows, ensuring effective due diligence and regulatory compliance.

Learn more

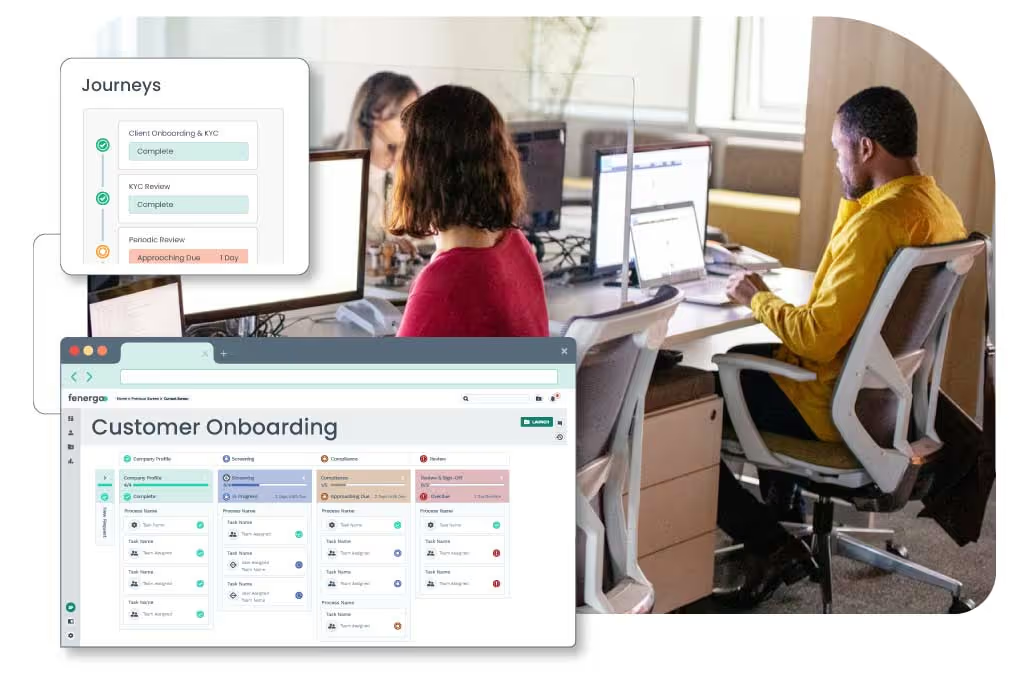

Client / Merchant Onboarding

A single, integrated onboarding solution to connect stakeholders and provide a single merchant view. Streamline and automate end-to-end onboarding journeys, including KYC/B and risk, digital outreach, risk assessment and PEP and sanctions screening.

Learn more

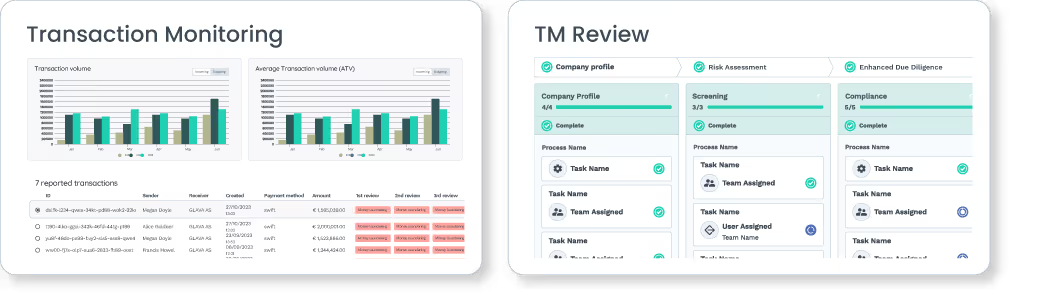

Transaction Monitoring

Detect suspicious activity in real-time, trigger alerts, investigate results and report financial crime to authorities. Transform transaction monitoring effectiveness, reduce false positives and manage risk exposure to combat Money Laundering and Terrorist Financing.

Learn more

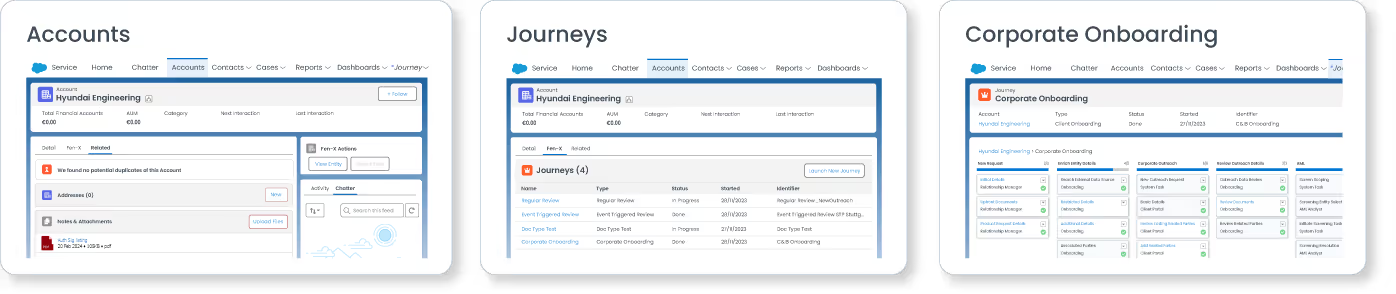

CLM for Salesforce

Provide Relationship Managers with real-time visibility over the end-to-end onboarding process directly from Salesforce, leveraging automatic updates & streamlined outreach, eliminating the reliance on ineffective email updates and duplicate requests for information.

Learn more

Advisory, Data & Product Partners

Fenergo partners with a host of market-leading advisory, implementation, data and product partners to create an end-to-end ecosystem of services and solutions for our clients.

.svg)

.svg)