29th September - 2nd October

Messe Frankfurt,

Stand C023

At Sibos 2025, We Invite You to Test Drive our Agentic AI-Powered Platform That is Leading the Way In FinCrime Compliance.

Discover How You Can Manage All Your KYC, AML, Transaction Monitoring, Client Onboarding and Client Lifecycle Events on a Single Intelligent Platform.

We'd love to show how Fenergo can help you fut

Stop by the Fenergo stand at 11am or 3pm each day for a hands-on demo and see how our AI-powered platform delivers results that speak for themselves.

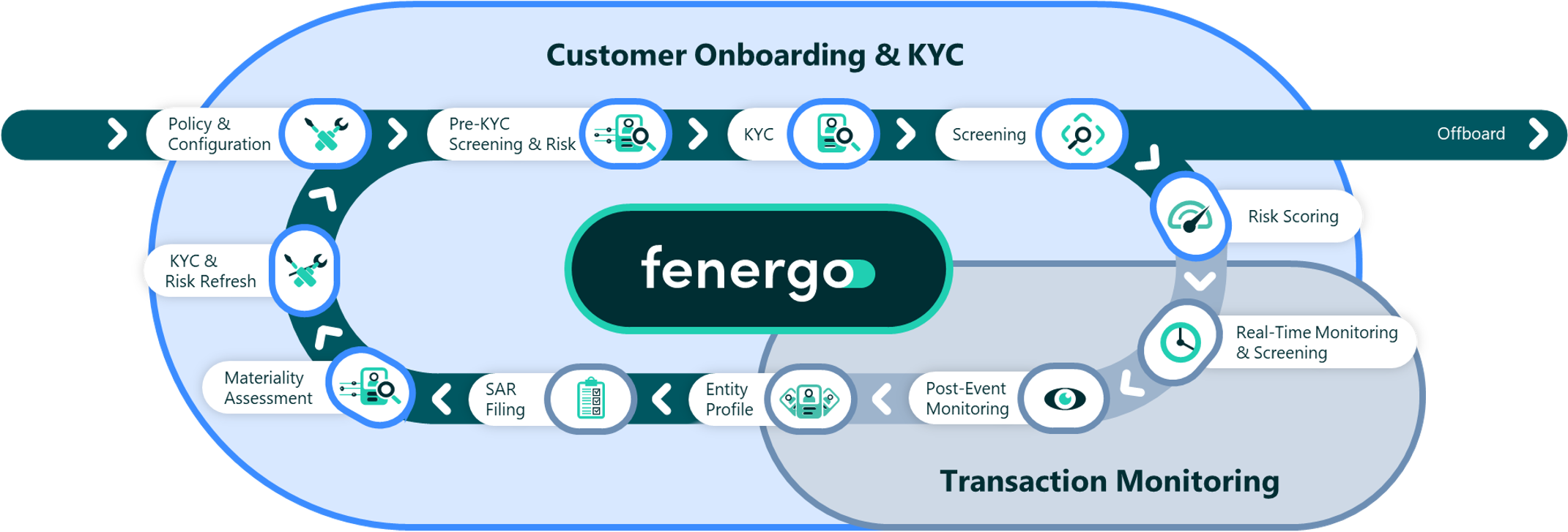

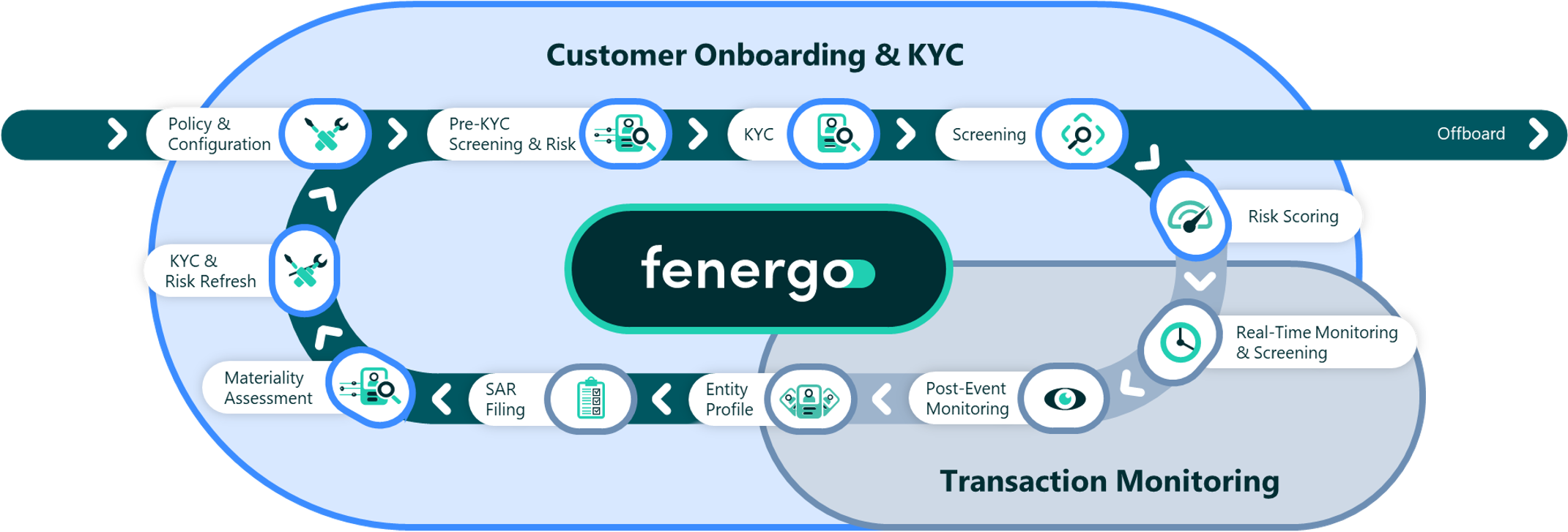

Our unified, AI-powered platform that centralizes the processing of all financial crime events, insights, and decisions across the client lifecycle.

It represents an evolution of Fenergo’s market-leading Client Lifecycle Management (CLM) capabilities into an intelligent, modular platform designed for a world of continuous compliance.

Fenergo’s FinCrime OS delivers:

Our suite of digital AI agents designed to eliminate toil and automate low-risk manual and repetitive tasks. Freeing up your compliance teams to focus on high-risk cases.

Discover how agents collaborate to achieve business outcomes like reducing KYC review backlogs.

Meet the Fenergo agents:

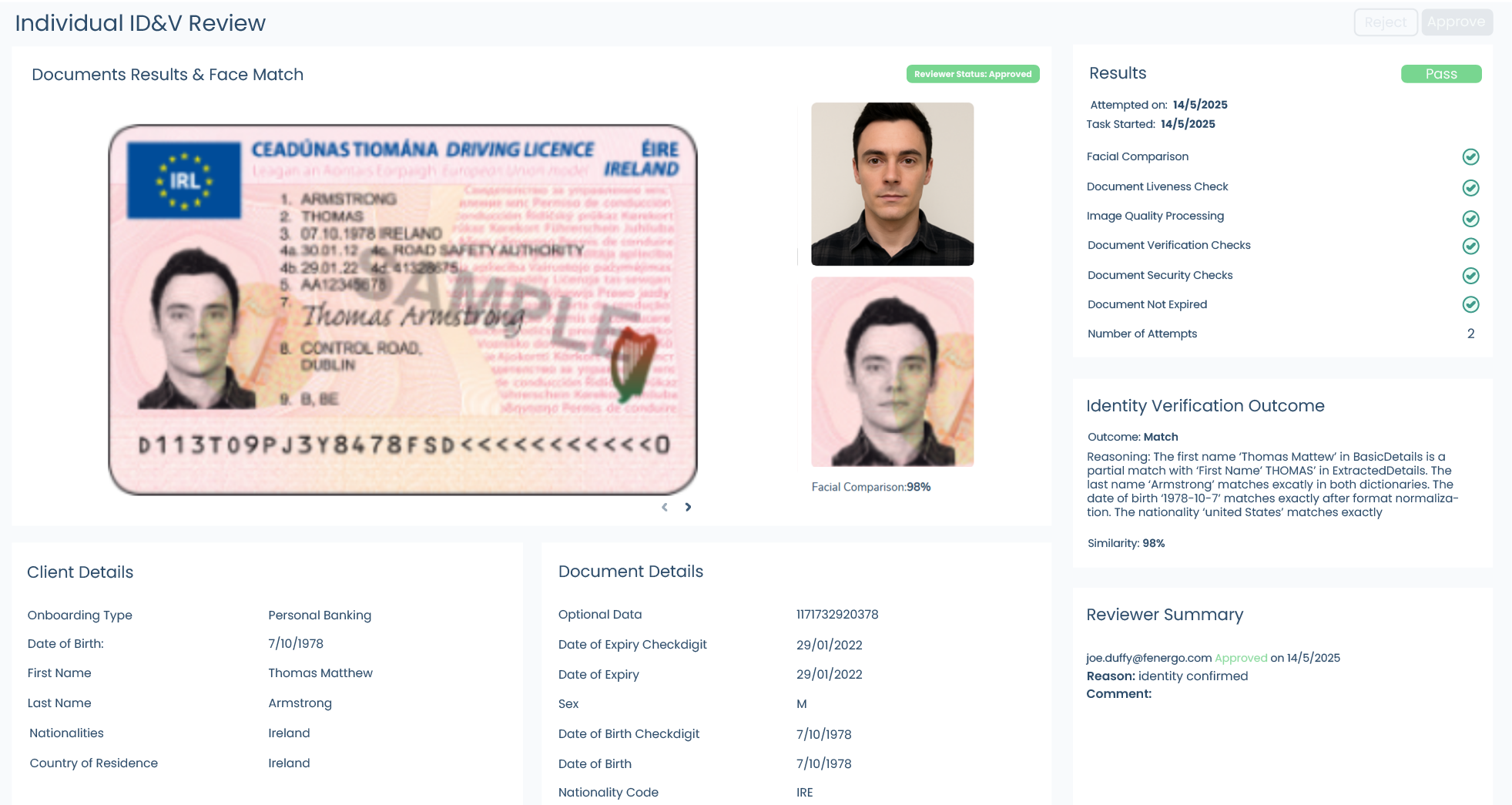

Fenergo’s Native ID&V solution empowers financial institutions to digitally verify individuals through a secure, seamless experience that’s embedded into the Fenergo FinCrime Operating System.

Combining document verification, biometric facial matching and liveness detection to enhance onboarding, reduce fraud and ensure regulatory compliance.

Fenergo offers a unified Know Your Customer (KYC) and Transaction Monitoring (TM) solution for a holistic approach to tackling money laundering and terrorist financing.

Allowing you to understand your clients and their behaviours to manage risk effectively throughout the entire lifecycle.

Our unified, AI-powered platform centralizes the processing of all financial crime events, insights and decisions across the client lifecycle.

It represents an evolution of Fenergo’s market-leading Client Lifecycle Management (CLM) capabilities into an intelligent, modular platform designed for a world of continuous compliance.

FinCrime OS delivers:

Our suite of AI agents designed to eliminate toil and automate low-risk manual and repetitive tasks, freeing up your compliance teams to focus on high-risk cases.

Digital agents collaborate to achieve business outcomes like reducing KYC review backlogs.

Meet the Fenergo agents:

Fenergo’s native ID&V solution empowers financial institutions to verify individuals digitally and securely, through an experience that’s seamlessly embedded into our FinCrime Operating System.

Combining document verification, biometric facial matching and liveness detection to enhance onboarding, reduce fraud and ensure regulatory compliance.

Fenergo offers a unified Know Your Customer (KYC) and Transaction Monitoring (TM) solution for a holistic approach to tackling money laundering and terrorist financing.

Allowing you to know your clients, understand behaviors, and control your risk from end-to-end.

We’re hosting two sessions at Sibos this year across two stages. Join Fenergo experts live as we explore the future of compliance, AI and customer experience.

Compliance is a growing cost center for financial institutions, with global banks spending $250 billion annually on risk and compliance (Nasdaq + BCG). Yet despite these costs, innovation remains slow and onboarding processes are inefficient - KYC reviews average 90 days, and 67% of firms report losing clients as a result.

Agentic AI is set to transform compliance operations. Integrated into client lifecycle management(CLM) platforms, it can reduce operational costs by up to 93%, cut KYC timelines by 43%, and speed up document handling by 72%. Research by Fenergo and Chartis estimates UK and US financial institutions could save $3.05 million in compliance costs using this technology.

Despite its promise, adoption is hindered by concerns over data privacy, regulation and trust. In this session, Aoife Doyle, Fenergo’s VP of Product Marketing, will share the latest insights on agentic AI incompliance and demonstrate how CLM - driven by intelligence, trust and automation - can help institutions manage more clients, reduce errors and regulatory risk while turning compliance from a cost center into a growth engine.

Agentic AI is no longer a futuristic concept - it’s transforming financial institutions today. With 93% of firms actively implementing or planning adoption within two years, the shift is well underway. This panel explores how Agentic AI is revolutionizing compliance operations, delivering faster decision-making, enhanced fraud prevention and significant cost savings averaging $2.89 million annually.

Hear from industry leaders who are leveraging high technical expertise to drive real-world impact and discover why Agentic AI is becoming a cornerstone of strategic investment. Whether you're anticipating modest gains or multimillion-dollar efficiencies, this session will unpack the operational realities and future potential of Agentic AI in financial services.

Compliance is a growing cost centre for financial institutions, with global banks spending $250 billion annually on risk and compliance (Nasdaq + BCG). Yet despite these costs, innovation remains slow and onboarding processes are inefficient - KYC reviews average 90 days, and 67% of firms report losing clients as a result.

Agentic AI is set to transform compliance operations. Integrated into client lifecycle management (CLM) platforms, it can reduce operational costs by up to 93%, cut KYC timelines by 43%, and speed up document handling by 72%. Research by Fenergo and Chartis estimates UK and US financial institutions could save $3.05 million in compliance costs using this technology.

Despite its promise, adoption is hindered by concerns over data privacy, regulation, and trust.

In this session, Aoife Doyle, Fenergo’s VP of Product, will share the latest insights on agentic AI in compliance and demonstrate how CLM - driven by intelligence, trust and automation - can help institutions manage more clients, reduce errors and regulatory risk while turning compliance from a cost centre into a growth engine.

Sed nibh leo, rutrum eu tempus sit amet, maximus ac lacus. Sed pellentesque vitae massa ac lacinia. Ut metus urna, pellentesque in velit ut, euismod cursus risus. Nullam elementum justo molestie venenatis laoreet. Nunc a tristique nisl.

Nunc maximus, mauris a convallis hendrerit, magna enim congue leo. Sed nibh leo, rutrum eu tempus sit amet, maximus ac lacus. Sed pellentesque vitae massa ac lacinia.

Sed nibh leo, rutrum eu tempus sit amet, maximus ac lacus. Sed pellentesque vitae massa ac lacinia. Ut metus urna, pellentesque in velit ut, euismod cursus risus.

Join the Fenergo team at Sibos for a coffee and a conversation about your business goals and what’s shaping the industry.

Schedule in a 1:1 meeting or a Demo Jam session with our team.