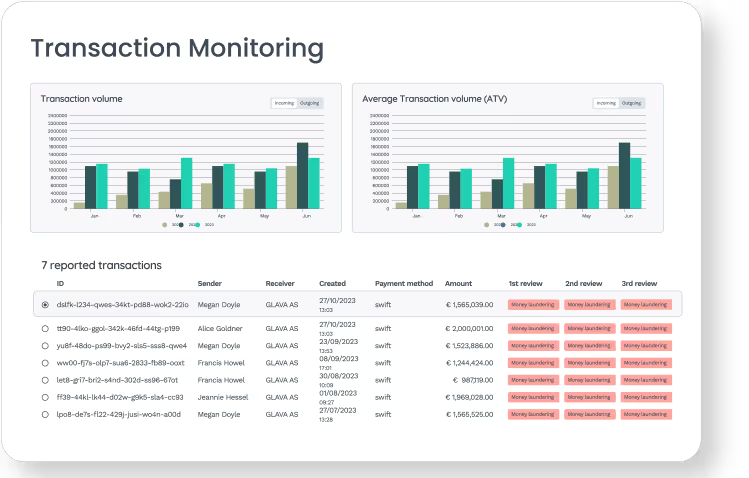

Discover The Power Of Fenergo Transaction Monitoring & AML

Transform AML Compliance with Fenergo Transaction Monitoring

Fenergo’s Transaction Monitoring tools offer effective, data-driven continuous transaction monitoring and alert management that reduces false positives, allowing you to focus resources on higher-risk customers and maintain AML compliance at scale.

Manage Compliance & Reduce Risk

Future-proof compliance with pre-packaged detection rules, workflows and reports, as well as continuous monitoring of global and local Anti-Money Laundering (AML) regulations.

Improve Operational Efficiencies

Reduce false positives with a unique hybrid detection model. Our collection of robust detection scenarios optimize performance of AML processes and minimize false positives.

Reduce Total Cost of Ownership

Configurable, scalable and flexible – Fenergo Transaction Monitoring connects all elements of the AML process, including entity profile data, risk scoring and sanctions screening.

No-code configuration empowers your business to adapt the solution to suit your business needs and the customers and jurisdictions you serve.

Market Leader for KYC & Client Lifecycle Management

Why organizations choose us

BNP Paribas’ groundbreaking One KYC Initiative - for collecting, storing and maintaining information and documents for Know Your Customer (KYC) and Client Onboarding - has transformed how the Bank serves its corporate and business clients globally.

A story of a successful partnership with Fenergo, this story reveals the mindset behind large-scale transformation - how a respected institution embraced change to deliver faster onboarding and reviews, stronger governance, and a more connected experience for clients.

As one of the largest financial services firms in the US, StoneX wanted to offer a better client experience. It selected Fenergo to digitalize client onboarding and KYC processes, which resulted in increased operational efficiencies that is transforming the client experience, thereby unlocking revenue potential.

Frequently Asked Questions

What is AML Transaction Monitoring?

Transaction monitoring is critical to the financial system. It helps institutions to detect and investigate suspicious transactions and report them to the relevant authorities. This helps to identify bad actors and keep the financial system safe. Transaction monitoring is a regulatory obligation for all regulated financial institutions.

What are the key processes involved in Transaction Monitoring?

Detect. Using methods, usually rules, to identify unusual or suspicious transactions that are flowing through the financial system. Examples include unusually high value transactions, or money flowing to/from restricted countries.

Investigate. The process of analyzing a suspected suspicious transaction and the associated transaction data, and the data of the involved parties, to determine if it is truly suspicious or a genuine transaction (aka. a false positive).

Report. Notifying the relevant authorities (local Financial Intelligence Unit - FIU) of the suspicious transaction and handing over information you have gathered to aid them in further investigations into the incident.

Continuous Monitoring. Ongoing monitoring of the same accounts to identify any further incidents of suspicious behaviour.

What are the biggest challenges for financial institutions with AML Transaction Monitoring?

1. The high volumes of false positive alerts that are generated causes a lot of strain on compliance teams; they spend too much time investigating transactions that turn out to be genuine.

2. Siloed KYC and transaction data. In order to make informed and accurate decisions on suspicious activity it is crucial that you have access to both KYC and transaction data for clients. KYC information forms the basis for how we determine if transactions are suspicious in many cases. For example a person with a monthly income of €5k suddenly receives €20k into their account, this can be deemed suspicious as it is unusual activity for their account.

3. Poor data analytics, dashboards and reporting are a real problem for compliance managers. Without the ability to analyze trends in suspicious activity or performance in detection scenarios it is impossible to adjust and improve to effectively lower false positive rates.