Discover The Power of Fenergo CLM

- Achieve operational efficiency, leveraging purpose-built AI Agents

- Align with AML, KYC and regulatory standards

- Reduce the total cost of ownership with advanced API integrations

Request a free demo

We'd love to show how Fenergo can help you fut

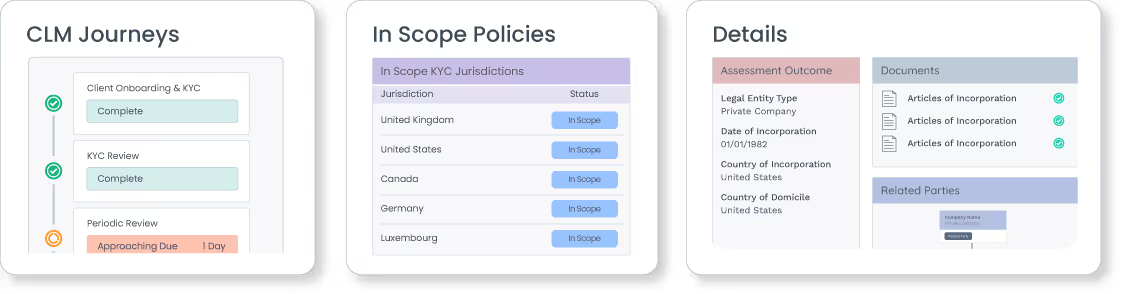

Centralize Client Data into a Single Entity Profile

Digitally transform your client management and compliance operations with AI-powered CLM from Fenergo, reduce the total cost of ownership and streamline operations.

Regulatory & Commercial Safety

Faster Client Onboarding

Improved Operational Efficiencies

Introducing Fenergo AI Agents

Deployed across the Fenergo FinCrime Operating System, our first cohort of intelligent, purpose-built agents are transforming client lifecycle management with speed, accuracy, and compliance.

Document Agent

The paperwork eliminator

Fenergo AI Document Agent uses generative AI and large language models to classify, extract and validate client documents powering faster, smarter onboarding, KYC reviews and AML due diligence.

Automate the heavy lifting, cut onboarding times, and slash operational costs.

Less paperwork. More progress.

Data Sourcing Agent

The profile optimizer

Fenergo’s AI Data Sourcing Agent automatically pulls, compares and prioritizes KYC data from multiple sources to streamline onboarding and reviews.

- Rules-driven automation across entity resolution, data validation and enrichment

- Cleaner data, faster decisions, and serious time savings

Smarter sourcing. Stronger profiles.

Screening Agent

The false positive killer

Fenergo’s AI Screening Agent automates match resolution and real-time explainable decisions - all with built-in human oversight.

Say goodbye to manual reviews and hello to faster, audit-ready results.

Consistent, scalable, and compliance-ready from day one.

Significance Agent

The noise silencer

Fenergo’s AI Significance Agent uses intelligent change classification to instantly flag high-impact client data updates, so your teams can skip the noise and focus where it counts.

No more wasted time on low-impact updates. Just smarter reviews, faster decisions and leaner workloads. Clarity at speed.

Autocompletion Agent

The straight-through processer

Fenergo Autocompletion Agent leverages policy rules to drive true straight-through processing with human intervention by exception.

Less effort, faster progress, and more time for what really counts.

Effortless execution. Maximum efficiency.

Kyra

The digital assistant

Kyra is your digital AI assistant that leverages natural language processing, large language models and generative AI to return data and insights to users.

Access Kyra from anywhere and gain valuable insights to help you make decisions.

Easy to use with natural language querying making Kyra accessible to all users.

Document Agent

The paperwork eliminator

Fenergo AI Document Agent uses generative AI and large language models to classify, extract and validate client documents - powering faster, smarter onboarding and KYC reviews.

Automate the heavy lifting, cut onboarding times, and slash operational costs.

Less paperwork. More progress.

Data Sourcing Agent

The profile optimizer

Fenergo’s AI Data Sourcing Agent automatically pulls, compares and prioritizes KYC data from multiple sources to streamline onboarding and reviews.

- Rules-driven automation across entity resolution, data validation and enrichment

- Cleaner data, faster decisions, and serious time savings

Smarter sourcing. Stronger profiles.

Screening Agent

The false positive killer

Fenergo’s AI Significance Agent uses intelligent change classification to instantly flag high-impact client data updates, so your teams can skip the noise and focus where it counts.

Say goodbye to manual reviews and hello to faster, audit-ready results.

Consistent, scalable, and compliance-ready from day one.

Significance Agent

The noise silencer

Fenergo’s AI Significance Agent uses intelligent change classification to instantly flag high-impact client data updates, so your teams can skip the noise and focus where it counts.

No more wasted time on low-impact updates. Just smarter reviews, faster decisions and leaner workloads. Clarity at speed.

Autocompletion Agent

The straight-through processer

Fenergo Autocompletion Agent leverages policy rules to drive true straight-through processing with human intervention by exception.

Less effort, faster progress, and more time for what really counts.

Effortless execution. Maximum efficiency.

Kyra

The digital assistant

Kyra is your digital AI assistant that leverages natural language processing, large language models and generative AI to return data and insights to users.

Access Kyra from anywhere and gain valuable insights to help you make decisions.

Easy to use with natural language querying making Kyra accessible to all users.

Market Leader for KYC & Client Lifecycle Management

Why organizations choose us

BNP Paribas’ groundbreaking One KYC Initiative - for collecting, storing and maintaining information and documents for Know Your Customer (KYC) and Client Onboarding - has transformed how the Bank serves its corporate and business clients globally.

A story of a successful partnership with Fenergo, this story reveals the mindset behind large-scale transformation - how a respected institution embraced change to deliver faster onboarding and reviews, stronger governance, and a more connected experience for clients.

As one of the largest financial services firms in the US, StoneX wanted to offer a better client experience. It selected Fenergo to digitalize client onboarding and KYC processes, which resulted in increased operational efficiencies that is transforming the client experience, thereby unlocking revenue potential.

Frequently Asked Questions

What is CLM?

CLM serves as an exhaustive architecture that evaluates each stage of customer engagement with a financial institution. It extends beyond traditional CRM systems by offering meticulous analytics that detail each facet of the client's journey through the lifecycle.

Read more here.

What does the future of CLM look like?

The financial industry is on the brink of a watershed moment, and the future of CLM undeniably lies in AI. It's no longer a question of whether to adopt AI, rather how to implement it safely and effectively.

Read more here.

How do AI and automation improve CLM?

AI and other automation processes create a systematic solution that streamlines CLM. Doing this transforms routine tasks. In turn, this allows human resources to focus on more valuable initiatives.

Read more here.